Finance minister says government will widen tax base to generate revenue during the next fiscal year

The government has announced that it would increase its spending on public sector programs by 38 percent during the financial year 2021-2022.

According to Business Recorder’s research cell, with Rs353 billion spent on development projects, government’s spending on Public Sector Development Program during the ongoing fiscal year was less than what the Planning Commission had authorized. This figure does not take into account the surge in inflation during the said fiscal year.

However, recently, government officials have repeatedly mentioned their interest in increased developmental spending during the Pakistan Tehreek-e-Insaf’s fourth year in power. Last month, Prime Minister Imran Khan himself stressed the need for including more projects in the development program to push the economy towards growth.

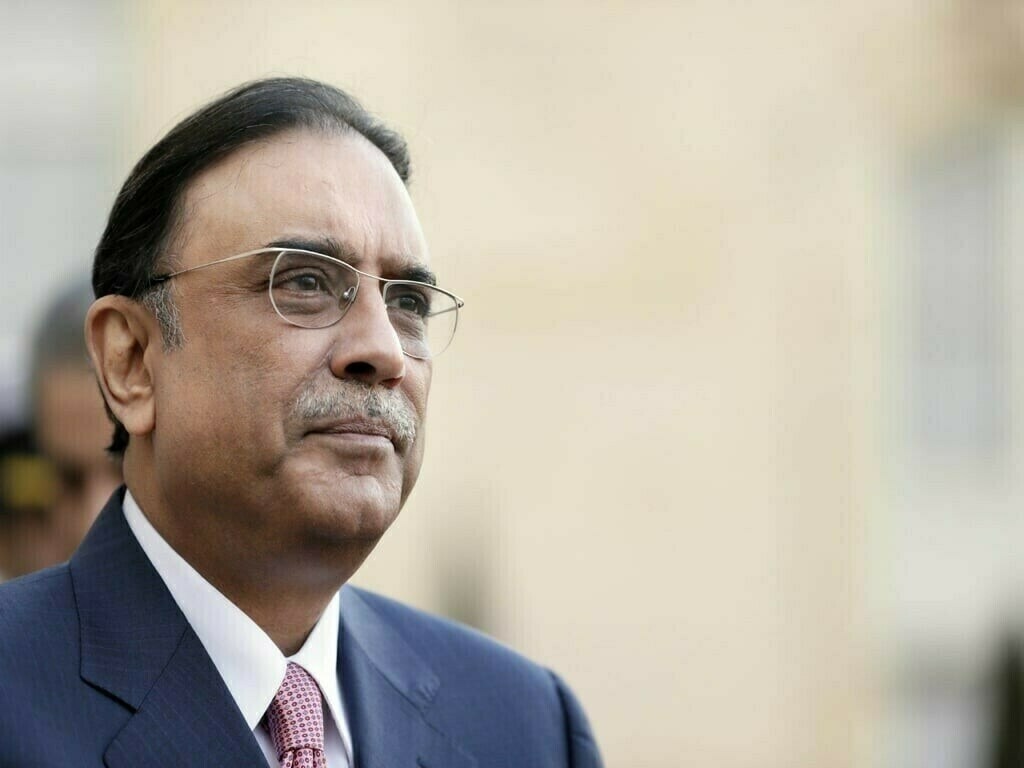

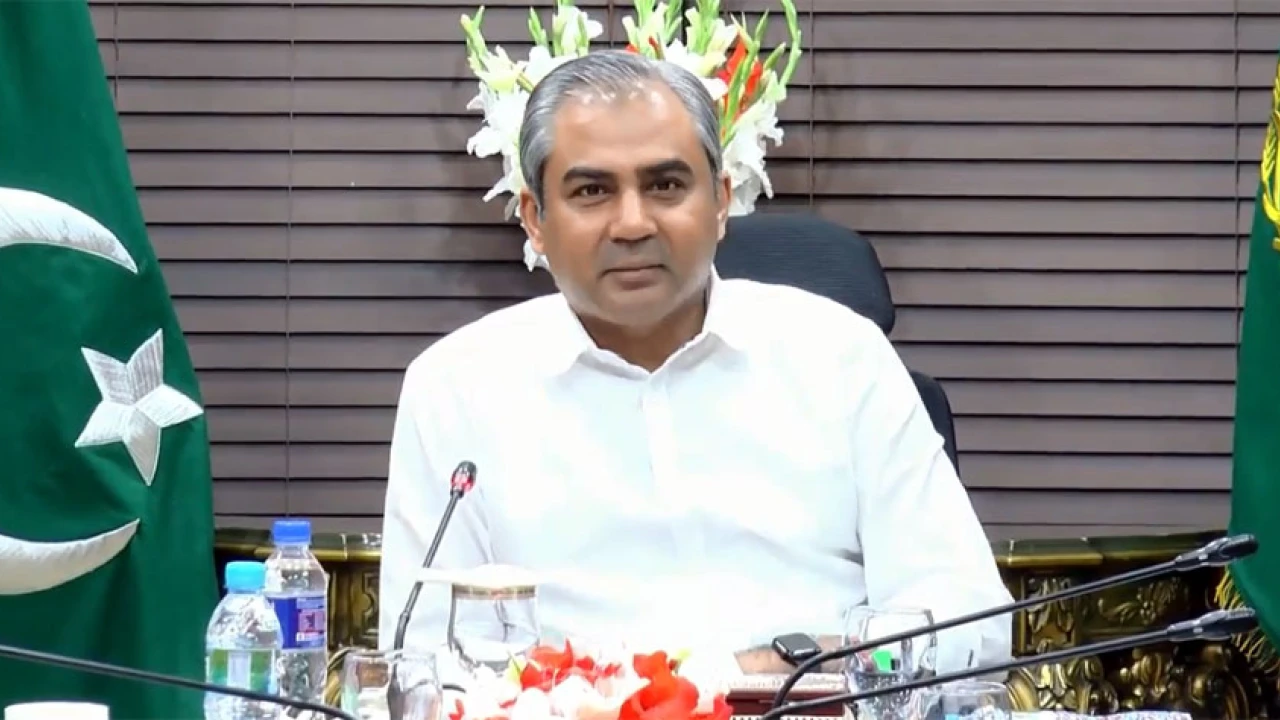

On Wednesday, the Economic Coordination Committee of the federal cabinet, which met with Minister for Finance Shaukat Tarin in the chair, also approved a supplementary grant for lawmakers to finance development projects in their respective constituencies.

On Thursday, while addressing a joint press conference with Minister for Energy Hammad Azhar and Minister for Economic Affairs Khusro Bakhtiar, Tarin once again reiterated the government’s objective of enhancing revenue collection during the next fiscal year. Announcing Rs5.8 trillion as the revenue target for FY22, he said that the government has planned a 20 percent increase in revenue for subsequent years.

Citing the government’s success in “bringing economic growth close to 4 percent” during the pandemic, the finance minister expressed confidence in the government’s ability to achieve a 5 percent growth rate during the next financial year.

Tarin once again highlighted that the government will not impose any new taxes in the budget for FY22, rather it would widen the tax base to generate more revenue.