The government has stepped up and is taking measures to provide its population with some much-needed relief during these difficult times

Pakistan has unfortunately found itself deep within the trenches of economic decline and a rapidly spreading recession. Said recession has seemingly left no stone unturned, affecting everything from large corporations to individual members of society. The sheer level of inflation has caused many problems: purchasing power has fallen to an all-time low, the foundations of livelihood have been threatened, and socio-economic disparities have been intensified. The severe problems in budgeting and finance have only been the tip of the iceberg.

In such trying times then, there have been many that have been turning towards the government to call out for providing some form of relief. People have been hoping for assistance in the form of tax incentives, subsidies, as well as financial support programs. The All Government Employees Grand Alliance (AGEGA) has also come forward to speak up, demanding that relief be provided to the thousands of employees of the federal government that have faced a great amount of struggle due to inflation.

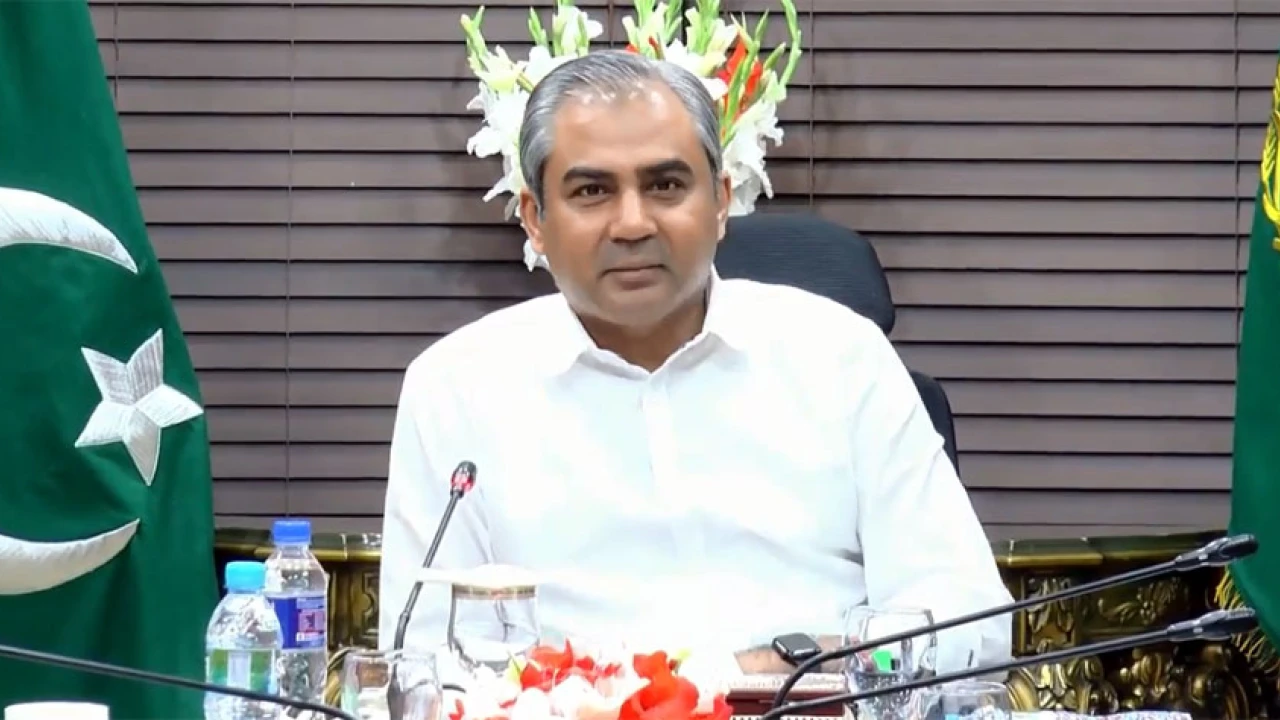

Fortunately, there is good news. The government has stepped up and is taking measures to provide its population with some much-needed relief during these difficult times. While chairing a recent meeting to review the budgeting plans for 2023 – 2024, Prime Minister Shehbaz Sharif reassured that every possible step would be taken to contain the crisis and protect the financial power of the lower-income members of society.

To this end he has announced that the government’s economic team has been instructed to make use of all possible resources in order to provide “maximum relief” to the budgeting troubles of the general public in Pakistan. Such relief measures have the potential to ease financial constraints, enhance purchasing power, and enable individuals to meet their day-to-day needs more comfortably.

Proactive steps are also being taken towards promoting the enhancement of industrial growth by allocating more funds towards small, medium, and large-scale industrial production and removing any unnecessary hindrances like regulatory burdens. This holds the potential to address the budgeting and financial troubles in our economy. By allocating more funds to the industrial sector, job creation can be stimulated, economic activity can be boosted, and revenue generation can be enhanced for corporations and individuals alike.

Another useful measure has been taken by the government in announcing major tax relief on laptops, PCs, hardware, and battery parts with the aim of bolstering the IT sector in Pakistan. Finance Minister Ishaq Dar has enabled provisions under which IT-enabled service providers will have the chance to import software and hardware – equivalent to one percent of their exports – completely free from any tax liabilities.

By reducing tax burdens on essential IT equipment, the government is facilitating easier access to technology, which is a crucial component if we wish to remain productive and innovative in today’s digital age. These tax exemptions further encourage investment and growth in the sector, and will not only contribute to budget relief for many businesses but will also equip individuals with the necessary tools required for personal and professional growth without experiencing large financial strain.

It does not end there! The government has indeed taken thorough note of the financial crisis that the people have found themselves in, and have initiated more specific, immediate relief measures. Among these are:

- Increase in the Benazir Income Support Program (BISP) allocation from Rs400 billion to Rs450 billion

- Targeted subsidy on wheat flour, ghee, pulses, rice through the Utility Stores Corporation (USC)

- Increase in salaries of civil servants in the form of Ad-hoc Relief Allowance

- Increase in rate of daily and mileage allowance

- Increase in rate of additional charge current charge allowance

- Increase in rate of orderly allowance

- Increase in rate of special conveyance allowance for disabled

- Increase in pension as well as an increase in minimum pension to Rs12,000

- Minimum wage increase from Rs. 25,000 to Rs. 30,000 in ICT Loan write-off scheme for widows

- Health insurance card for working journalists and artists

These measures will provide struggling families with easier access to essential commodities, and the adjustment in several allowances will ensure a more stable income for the employees in the public sector of Pakistan. Moreover, the minimum wage increase, loan write-off scheme, and improved pension system will all provide some much-needed support to the vulnerable segments of our society.

The proactive approach displayed by the government in tackling the recent budgeting problems has done wonders in demonstrating their commitment to aiding their citizens, winning back their trust, and fostering an environment of economic stability once more. Their measures hold significant promise for individuals facing financial and budgeting troubles and their dedication to providing relief is sure to have a positive impact on the lives of ordinary Pakistanis, supporting their financial well-being and helping them navigate these challenging times with greater support and confidence.